How solar energy works

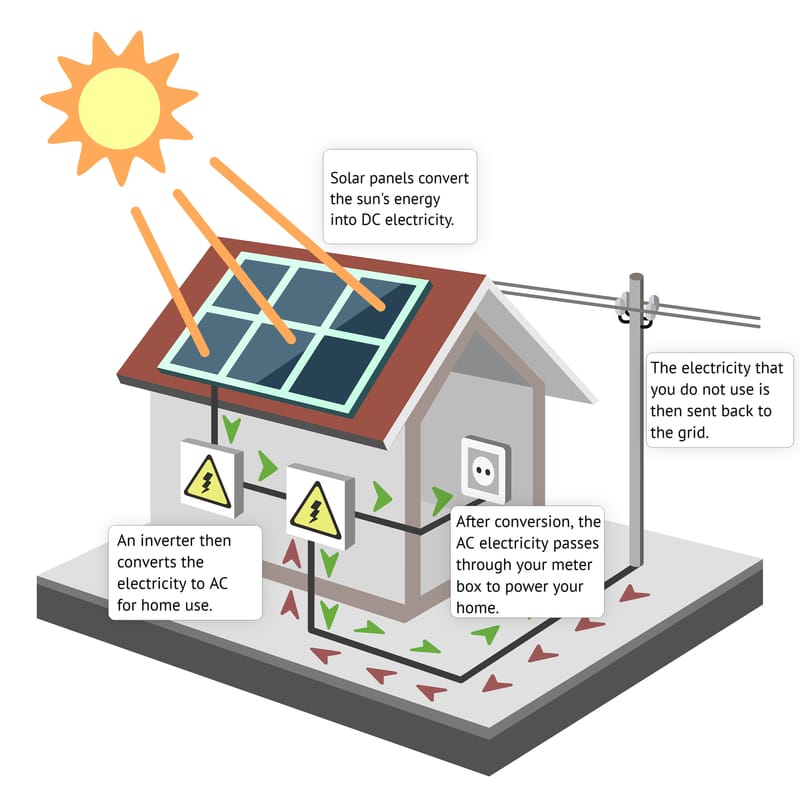

Solar panels are used to collect the sun’s rays and convert that energy into electricity. An inverter changes the voltage from DC volts to AC volts. After the power has passed through the inverter, it then goes into the electrical panel. The power can then be used for home or business. Excess power produced by your solar panels can then be sold back to the power company.

History |

Using solar energy to produce electricity isn’t a new concept. The first solar panel manufactured with the same compounds as modern solar panels was produced in 1954. In 1956, laboratories began to construct satellites that used solar power as the primary source of power while orbiting the earth. Research and testing have allowed the cost of solar system installation to decrease from over $100 dollars per watt in 1954 to less than $5 dollars per watt today. Efficiency of solar panels has significantly increased and has allowed the average home or business to utilize this form of energy. With the increased stress on the electrical grid, states are beginning to enforce renewable energy.

|

Advantages of Solar |

Solar electric is a growing industry that allows homeowners and businesses to produce the electricity that they need and save money on utility bills. Installing solar power helps in saving the environment and ensures clean air for our future. The most common way of producing electricity in today’s world is by burning coal, natural gas, or using nuclear power. Producing electricity like this isn’t clean because of emissions that are released into the air. Coal and natural gas are resources that are becoming harder to find. Solar, wind, and hydroelectric power are clean ways of producing electricity without harming the environment and will ensure a clean future for our planet.

Installing a solar panel system will significantly decrease or eliminate your monthly electrical bill. There are many rebates available for installing solar systems. Solar rebates allow these systems to be more affordable. The government offers a 30% federal tax credit. This tax credit is available for any home or business excluding non-profit organizations. There are more incentives available for smaller populations if specific criteria are met. Our team will meet with you to see if any of the additional incentives are available for you. |